Know your borrowers, before they borrow

Better data drives better business outcomes and a more harmonized industry.

3

New active liens filed

Geographic Distribution

▲ 13

Highest Draw Highest draw amount outstanding

Balance $0

Highest Balance $63,890

Inspection Activity

Historical inspection

results dictate further

scrutiny and delays.

results dictate further

scrutiny and delays.

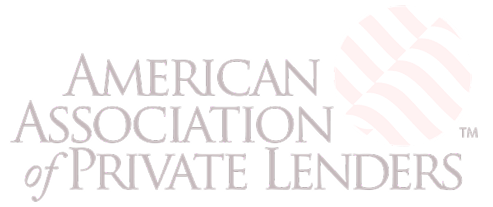

4598 Birch St

9823 Jonuvo Road

1186 Raddison St

55 Inverness Way

Welcome to your dashboard,

Andrew Park

REI PERFORMANCE INDEX SCORE

Michael Ray Hudson

Performance Index

TransUnion

Equifax

Experian

Payment History

100% Percentage of payments they’ve made on time

Project Success Rate

89% How much they’re using compared to their total limit

Fraud Detection

0% Cases of reported fraud

Credit Age

7 yrs Total length of credit history

Total Accounts

28 Total number of closed and open accounts

Draw Variance

12% Total number of times a lender has requested a report

Additional Guarantors

4

Previous guarantors used in

financing / collateral management.

financing / collateral management.

4

Multiple new entities formed

A system of record that

powers credit confidence

FRAUD PREVENTION

Historical Operations

API

Fraud Prevention

Risk Alerts: FraudGuard uses advanced network analysis and predictive scoring to

identify bad actors before they slip through the cracks.

Proactive Risk Management: Act early with predictive fraud insights and avoid costly

fraud losses.

Historical Operations

Risk Alerts: FraudGuard uses advanced network analysis and predictive scoring to

identify bad actors before they slip through the cracks.

Proactive Risk Management: Act early with predictive fraud insights and avoid costly

fraud losses.

Connect to the network,

with one click.

All-in-one API with a few lines of code

- Access readily available customized UX/UI..

- Embed directly into your own system.

- REST API access with simple documentation.

PROJECT PROGRESSION

National Coverage. Neighborhood Focus.

Data coverage in all 50 states.

What industry

leaders have to say

Better than the status quo

RE Score

Timeliness of data

Often 90 - 30 days old

1 - 30 days old

Personal + Outside Corporate Interests

Primarily personal

Personal + Corporate Liens, Judgements, Bankruptcies

Primarily personal, with min. corporate credit history unless lien registered

Visibility into Related Entities (Brokers, Appraisers, Inspectors, others)

Primarily personal, other entity connections often not found

Reporting and Analytics

Primarily personal credit history

Fraud Detection

Inadequate fraud risk assessment & bad actor profiles

Frequently Asked Questions

No, we are not a bank. We are a financial technology company that partners with licensed banks to provide our services. Your funds are held at FDIC-insured partner banks, ensuring your money is protected up to $250,000.

You can get started with InstaFi in just a few minutes! Simply download our app, verify your identity with a government-issued ID, and link your bank account. Most users are up and running within 5-10 minutes.

InstaFi offers transparent pricing with no hidden fees. Our basic plan is free and includes essential features like account management, transfers, and mobile check deposits. Premium plans start at $9.99/month and include additional features like investment tools, higher transfer limits, and priority customer support.

Yes! InstaFi integrates seamlessly with popular financial software and tools. We offer API access for businesses, integration with accounting software like QuickBooks and Xero, and compatibility with budgeting apps. Our open banking approach ensures you can connect your existing financial ecosystem.